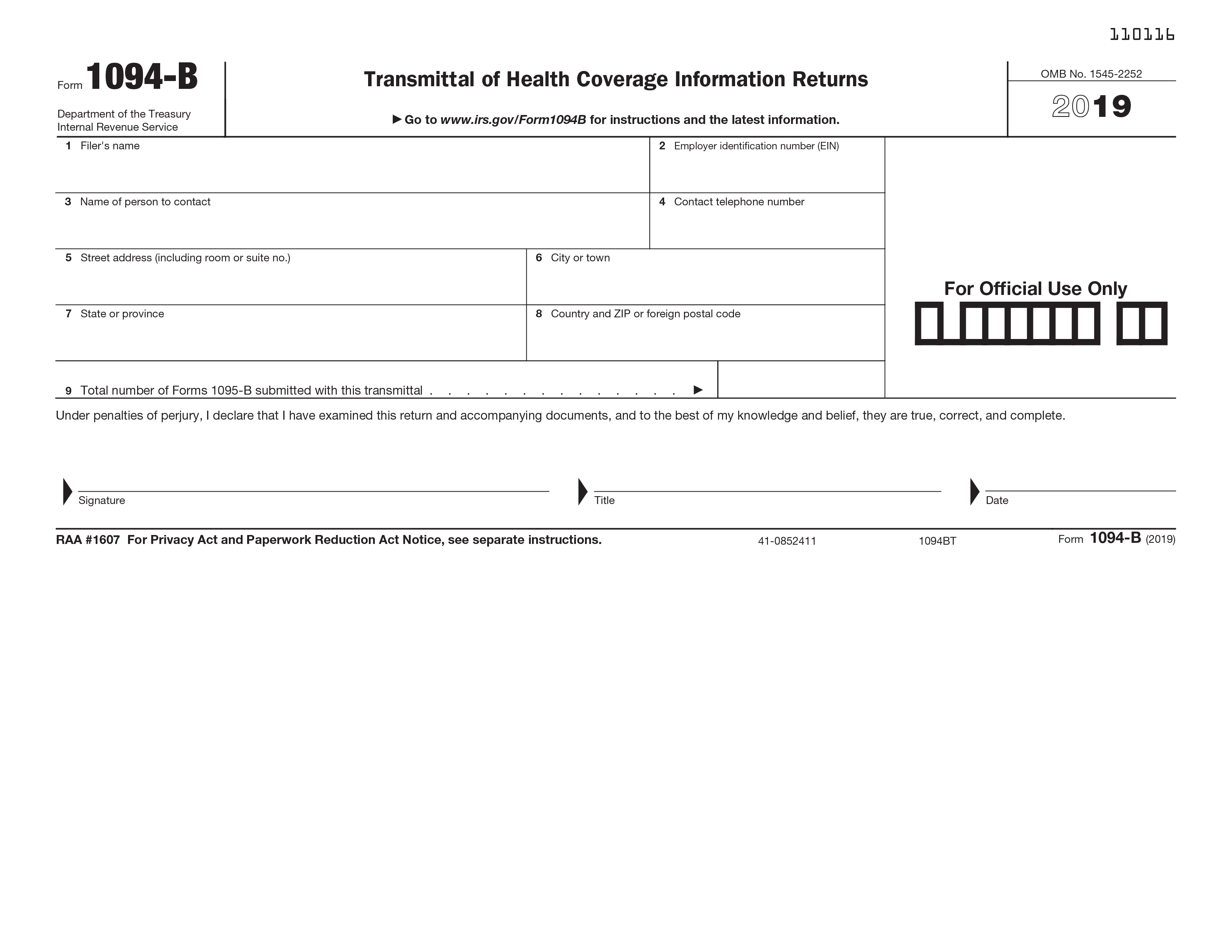

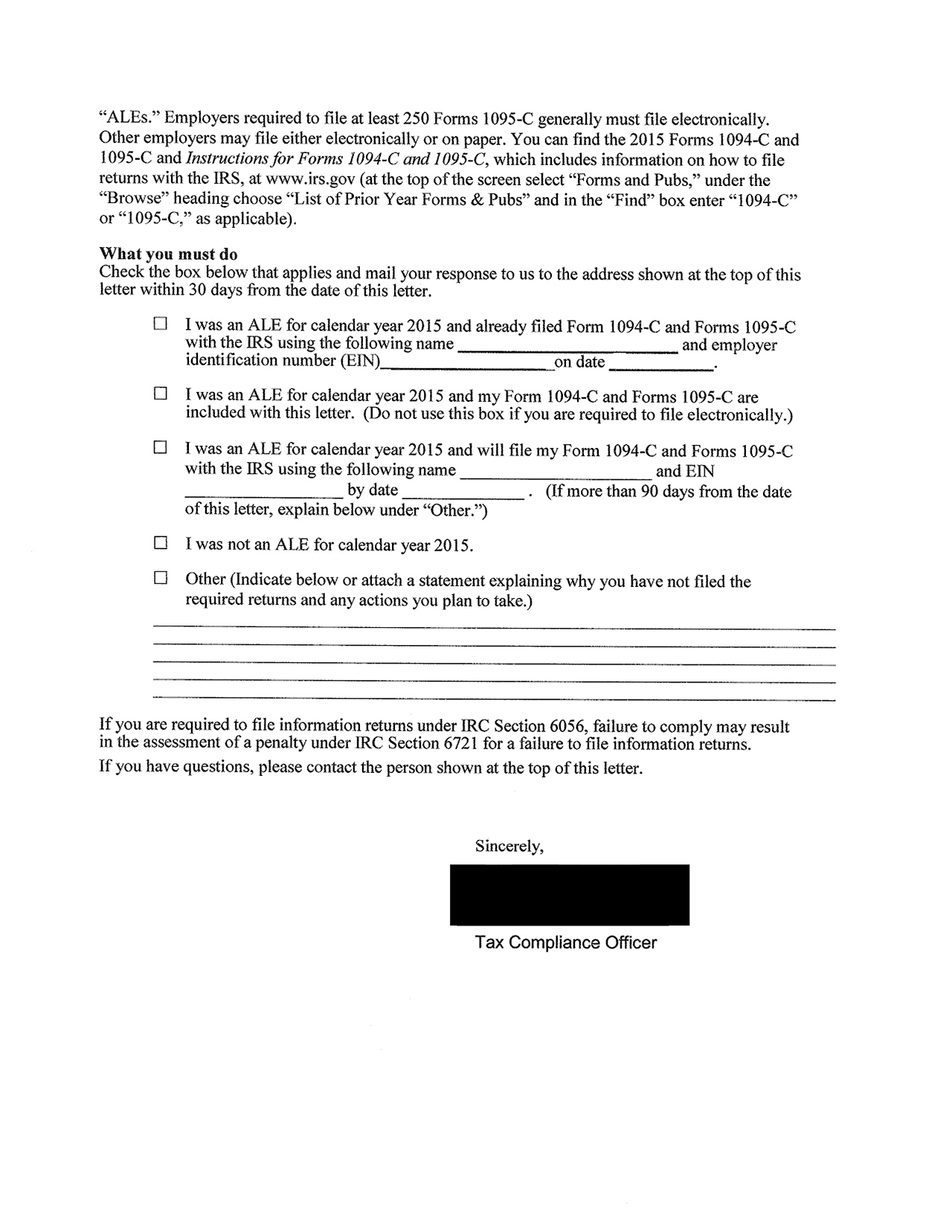

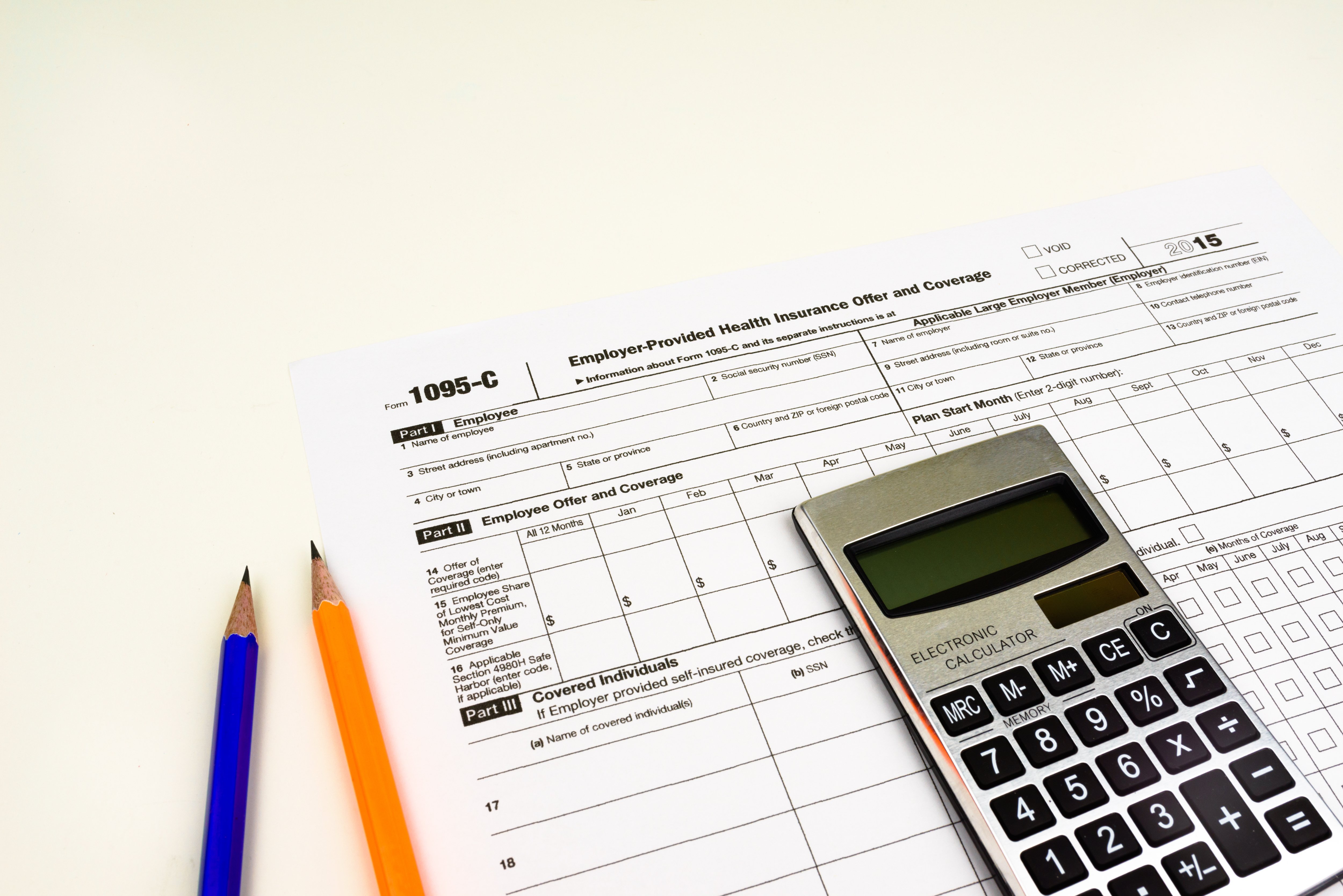

New ACA Forms Issued by IRS The IRS issued final versions for four ACA forms, including Forms 1094B, 1095B, 1094C, and 1095C The forms can be accessed using the following links The IRS also released full instructions for Forms 1094C and 1095C for employers and HR teams, as well as instructions for Forms 1094B and 1095BInstructions for Forms 1094C and 1095C 14 Form 1095C EmployerProvided Health Insurance Offer and Coverage Form 1095C EmployerProvided Health Insurance Offer and Coverage 19 Form 1095C EmployerProvided Health Insurance Offer and Coverage 18 Form 1095C EmployerProvided Health Insurance Offer and Coverage 17 Form 1095C For the filing year, Applicable Large Employers (ALEs) must provide Forms 1095C to employees by ALEs must submit Forms 1095C, along with Form 1094C, to the IRS by (if filed by mail) or (if filed electronically) Note Employers that are required to file 250 or more 1095C Forms must file electronically

Form 1095 A 1095 B 1095 C And Instructions

2019 form 1094-c instructions

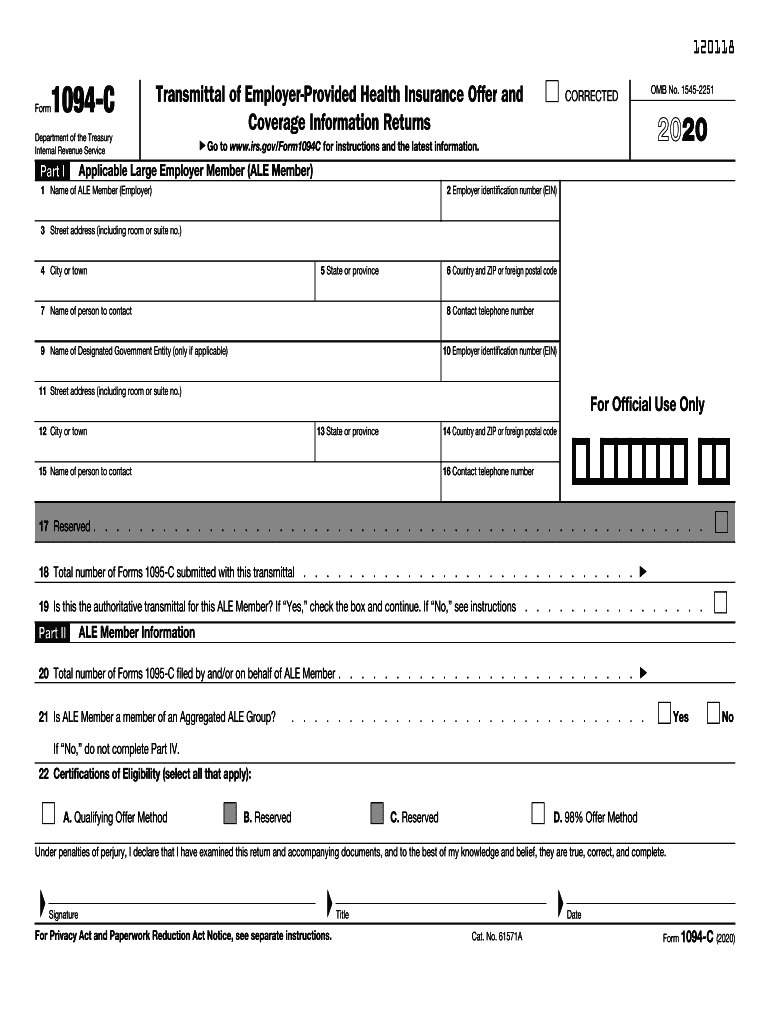

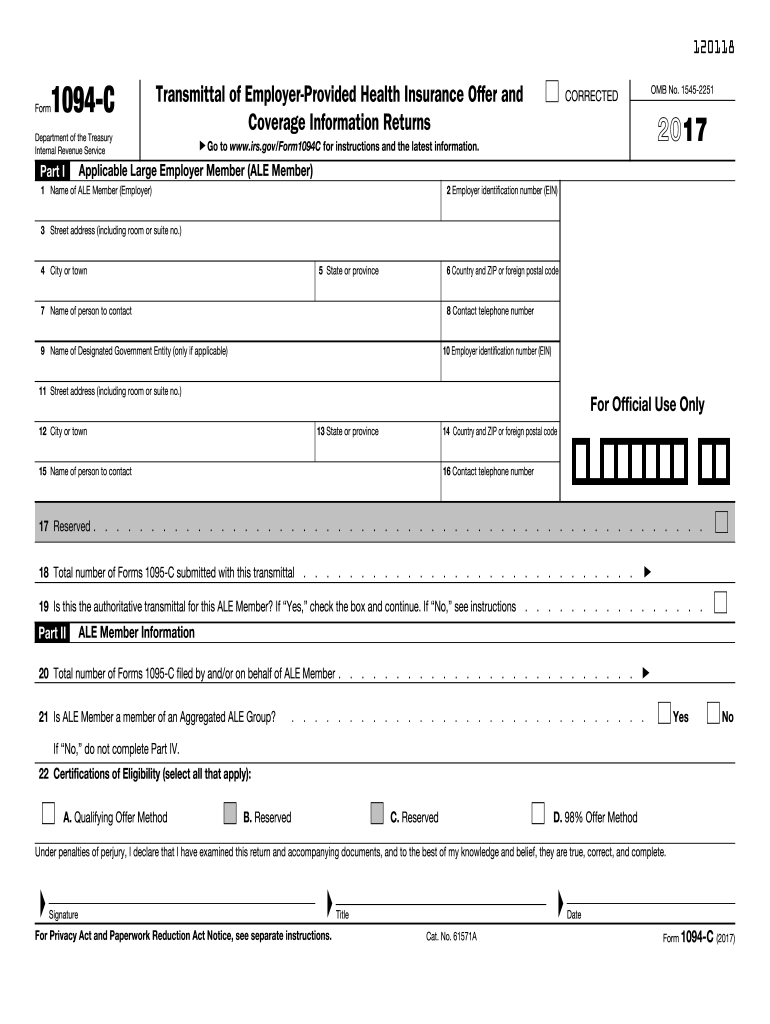

2019 form 1094-c instructions-Form 1094C, Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Return Filing is optional for CY 14, but required for Coverage Years starting in 15 All Applicable Large Employer (ALE) Members are required to file Forms 1094C and 1095C for Coverage Years starting in 1618 Form 1094C (transmittal form with copies of Forms 1095C) Due (or , if filing electronically) If the due date falls on a weekend or legal holiday, the employer may file by the next business day

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Enrollment in health coverage for their employees Form 1094C must be used to report to the IRS summary information for each ALE Member (defined below) and to transmit Forms 1095C to the IRS Form 1095C is used to report information about each employee to the IRS and to the employee Forms 1094C andForm 1096 Annual Summary and Transmittal of US Information Returns (Info Copy Only) Form 1097BTC Bond Tax Credit 1219 Inst 1097BTC Instructions for Form 1097BTC 1219 Inst 1097BTC Instructions for Form 1097BTC 19Form 1094C Department of the Treasury Internal Revenue Service Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns Go to wwwirsgov/Form1094C for instructions and the latest information OMB No 19 Part I Applicable Large Employer Member (ALE Member) 1 Name of ALE Member (Employer) 2

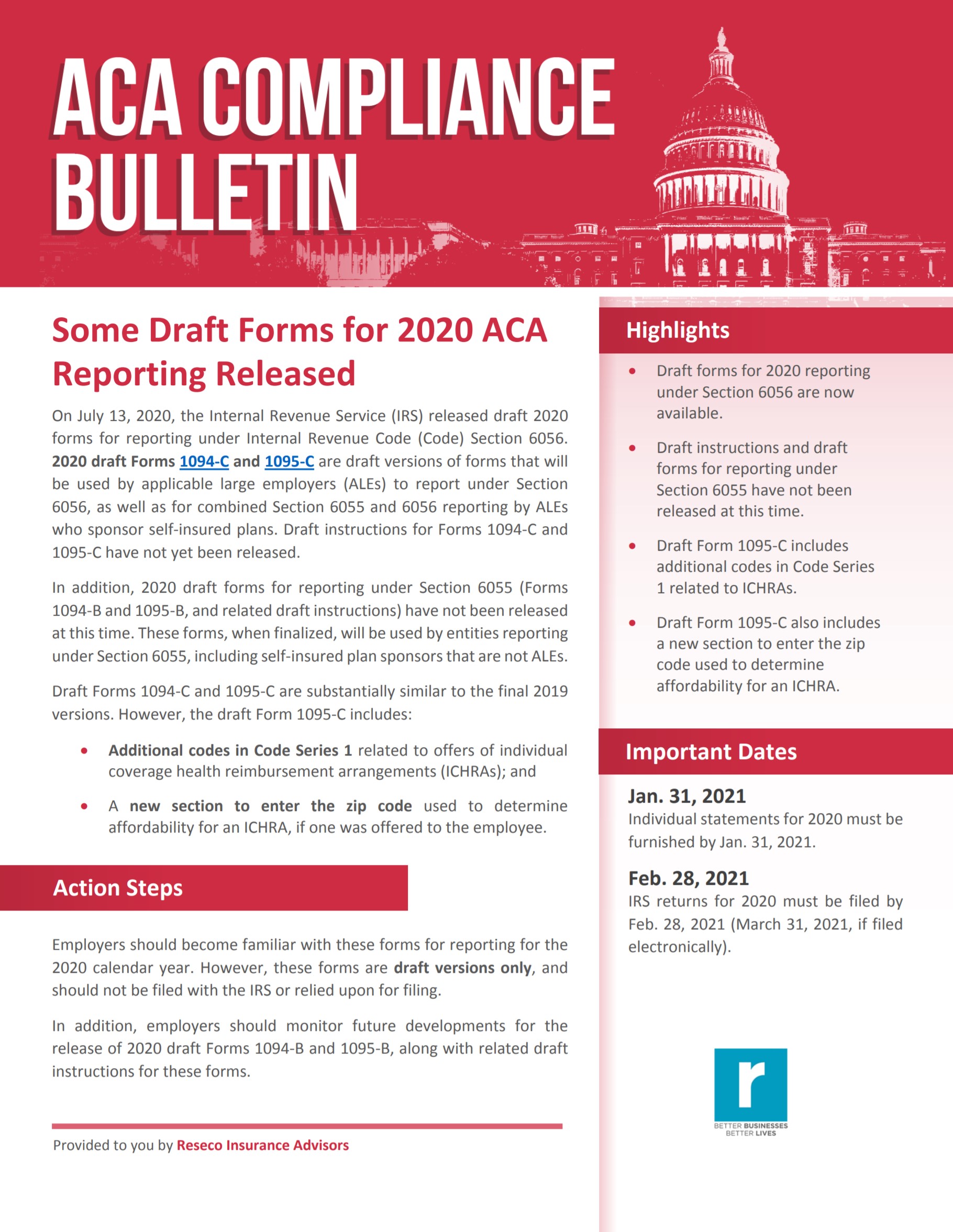

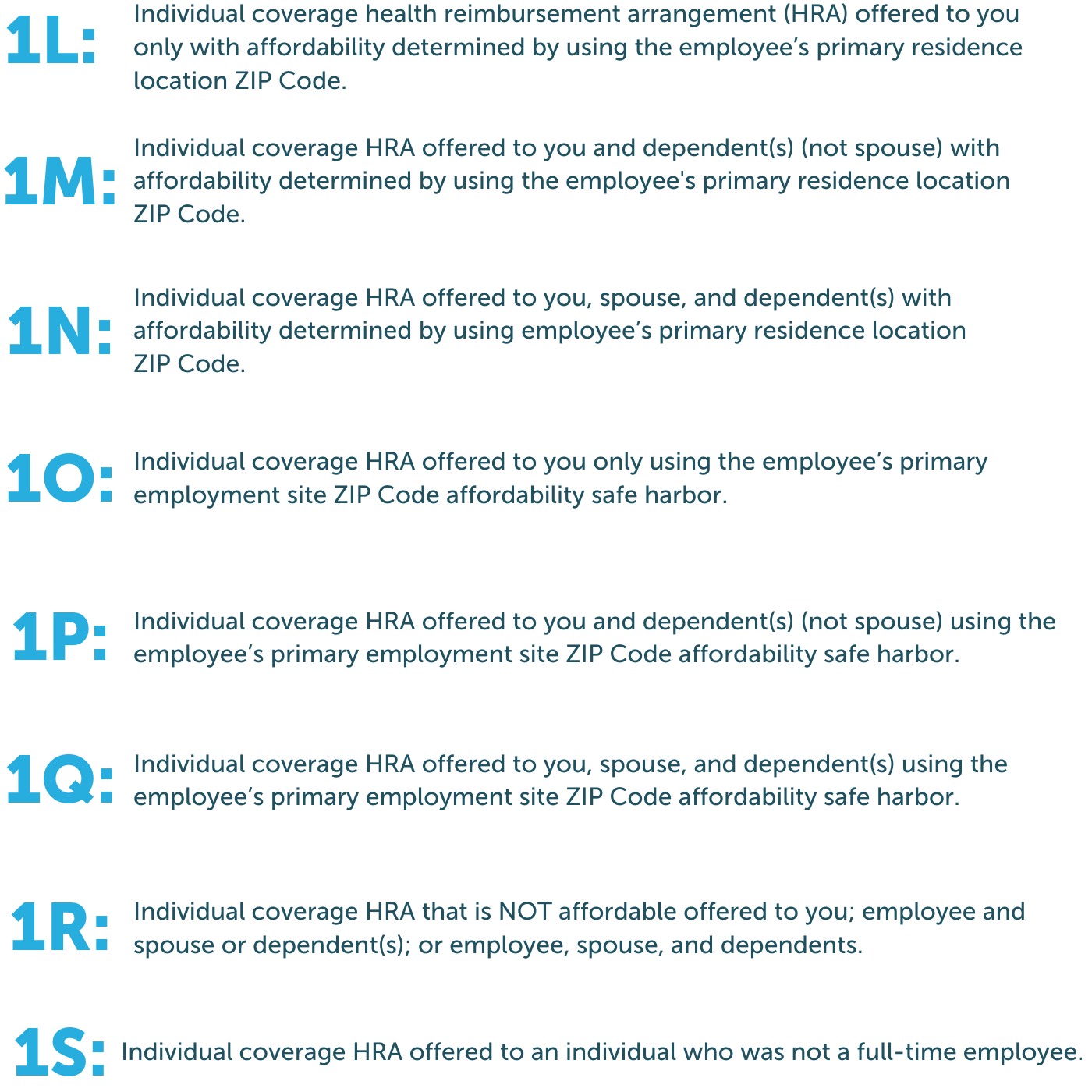

The IRS has released draft versions of Forms 1094C and 1095C, as well as the reporting instructions for the 19 tax year, to be filed and furnished in You can find the draft 19 filing instructions by clicking here The draft 19 versions of Form 1094C and 1095C are also available for download at the following links 19 Draft Form 1094C The Form 1095C is by far the more complicated Form and providers who are not automating the process will undoubtedly struggle to meet this deadline The deadline to file the Forms 1094C and 1095C with the IRS is if the employer is filing on paper If an employer is filing electronically, the deadline is1095c 1921 Complete forms electronically working with PDF or Word format Make them reusable by generating templates, add and complete fillable fields Approve forms with a legal digital signature and share them through email, fax or print them out Save blanks on your computer or mobile device Improve your productivity with effective solution?

The IRS released final 19 Form 1094C, Form 1095C and applicable instructions Applicable large employers 1("ALEs") must furnish the Form 1095C to fulltime employees2 and file Forms 1094C and all 1095Cs with the IRS3 WHAT'S NEW While the Forms remain substantially the same to last year's versions, the instructions highlight We are halfway through October and the IRS still has not released the draft Forms or instructions for the 1094C and 1095C In the past, the draft Forms and instructions for the 1094C and 1095C have been released inFrom the Affordable Care Act Reporting Workshop cosponsored by MedBen and Five Points ICT, presented on This segment includes information

Your 1095 C Obligations Explained

Irs Issuing 1094 C 1095 C Penalties Essential Staffcare

For calendar year 19, Forms 1094C and 1095C are required to be filed by , or , if filing electronically See Furnishing Forms 1095 C to Employees for information on when Form 1095 C must be furnished The 1094C form is not considered a correction by the IRS if it is being submitted as the cover page for one or more corrected 1095C forms The accompanying 1094C form is simply a new form and the data on it should reflect what is being submitted with it (eg, if 1 form needs correcting, Line 18 on the 1094 form will state "1" even though hundreds of forms were1921 form 1094c Fill out documents electronically using PDF or Word format Make them reusable by creating templates, add and complete fillable fields Approve documents with a legal digital signature and share them by using email, fax or print them out Save files on your laptop or mobile device Increase your efficiency with powerful service?

2

Form 1099 Nec Requirements Deadlines And Penalties Efile360

The electronic and paper filing deadlines have already passed for 19 ACA information Employers must provide this information to the IRS via Forms 1094C and 1095C ALEs must also provide a copy of Form 1095C to their fulltime employees, including to any person employed fulltime for one or more months of the reporting yearDraft Tax Forms Enter a term in the Find Box Select a category (column heading) in the drop down Click Find Click on the product number in each row to view/download Click on column heading to sort the list You may be able to enter information on forms before saving or printingForm 1094C is the transmittal form that accompanies Form 1095C when filing with the IRS each year Together, Forms 1094C and 1095C are used to provide information to the IRS regarding health insurance coverage offered to your fulltime employees and that status of individual employee's enrollment Form 1094C is only sent to the IRS, not to employees

Www Irs Gov Pub Irs Access F8508 Accessible Pdf

2

IRS Issues Draft 19 ACA Forms 1094C and 1095C and Reporting Instructions Joanna KimBrunetti The IRS has released draft versions of Forms 1094C and 1095C, as well as the reporting instructions for the 19 tax year, to be filed and furnished inBack to 1094C Form Guide ;19 form 1094c pdf 18 instructions form 1094c How to create an eSignature for the 16 form 1094 c Speed up your business's document workflow by creating the professional online forms and legallybinding electronic signatures

/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png)

About Form 1095 A Health Insurance Marketplace Statement Definition

Www Scu Edu Media Offices Human Resources Documents Benefits 1094 C 1095 C Forms Guidance Pdf

The IRS estimates that the Form 1094C alone can take up to four hours to complete The Form 1095C, which is sent to both employees and the IRS, clocks in at only 12 minutes per form For a company with 100 employees, that means you'll spend 25 hours completing them Let's make ACA reporting easierJohn Barlament walks through how to fill out IRS forms 1094C and 1095C This presentation was given to selffunded employers at an Alliance Learning Circle Checking the "Yes" box in Column (a) of the Form 1094C Necessary to Unlock the Section 4980H Affordability Safe Harbors for a Month The IRS recently sent a wave of Letters 226J to employers the IRS believes owe a section 4980H penalty

Otr Cfo Dc Gov Sites Default Files Dc Sites Otr Publication Attachments Dc health care info returns Pdf

Ez1095 Software How To Print Form 1095 C And 1094 C

The IRS has released final Forms 1094/1095B (B Forms) and Forms 1094/1095C (C Forms), and related instructions, for the 19 tax year No material changes have been made to the forms, either from prior years or from the drafts released in November (see our Checkpoint article ) (The "Instructions for Recipient" included with Form 1095B and The form requires basic information, such as the number of employees at an organization and how many 1095Cs are being filed Check out the recently released Form 1094C for the 19 tax year here What are the deadlines I need to know? The IRS released the draft instructions to the Forms 1094C and 1095C on While many, including us as discussed in our previous article, expected some changes as a result of the Individual Mandate being reduced to $0 beginning in 19, the draft instructions were virtually identical compared to the 18 iteration of the instructions

Irs Extends 18 Deadline For 1095c Forms Rancho Mesa Insurance Services Inc

Aca Forms 1094 C And 1095 C And Reporting Instructions For The Aca Times

Form 1094C contains information about the ALE, and is how an employer identifies as being part of a controlled group It also has a section labeled "Certifications of Eligibility" and instructs employers to "select all that apply" with four boxes that can be checked The section is often referred to as the "Line 22" question or boxes The IRS has released draft Forms 1094/1095B (B Forms) and Forms 1094/1095C (C Forms), and related instructions, for the 19 tax year As a reminder, the B Forms are filed by minimum essential coverage providers (mostly insurers and governmentsponsored programs, but also some selfinsuring employers and others) to report coverage information in accordance withApplicable large employers with 50 or more fulltime or fulltimeequivalent employees use efileACAforms to save on the labor costs of preparing, printing, mailing and manually submitting their 1095C and 1094C forms to the IRS Smaller, selfinsured employers who must fill out the 1095B and 1094B transmittal form use efileACAforms to report the names, addresses and

2

What To Do If Your Obamacare 1095 A Column B Is Zero Poorer Than You

Form 1094C Department of the Treasury Internal Revenue Service Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns Information about Form 1094C and its separate instructions is at wwwirsgov/form1094c OMB No 15 Part I Applicable Large Employer Member (ALE Member) 1 Name of ALE Member (Employer)Requirements for 19 NOTE This guidance does not provide complete details for groups of 250 or more employees Guide for brokers Sample Form 1095B Form 1094C and Form 1094C Instructions Sample Form 1095C 9495 eport equir 29 6 Guidance for Applicable Large EmployersNow that you understand the basics of 1094C/1095Cs, let's jump into the specifics for the 19 tax year

Dps Ascentis Aca Brochure Pdf 791x1024 1 Jpg

2

Each FullTime employee must be provided an IRS Form 1095C by IRS Form 1094C, along with all FullTime employees' Form 1095Cs, must be transmitted to the IRS by March 31 every year (April 1 in 19), if an employer files these Forms electronically The 1094C is your title page, and the 1095C is the actual report itself And in this case, the report contains vital details about each employee's health insurance for the year Together, these forms are used to determine whetherEmployers filing fewer than 250 statements may file by paper to the IRS no later than If a selffunded employer takes advantage of the relief available in Notice 1963, the employer must still file the Forms 19C

Www Cbiz Com Linkclick Aspx Fileticket Tiiy1s9y5pg 3d Portalid 0

1095 C Reporting How To Use Affordability Safe Harbors For Integrity Data

What Is Form 1094C? File a Form 1094C (do not mark the "CORRECTED" checkbox on Form 1094C) with corrected Form(s) 1095C Furnish the employee a copy of the corrected Form 1095C, unless the ALE Member was and continues to be eligible for and used the alternative method of furnishing under the Qualifying Offer Method for that employee for that year'sForm 1094C Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns 19 Form 1094C Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns 18 Form 1094C Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns 17 Form 1094C

2

Clearpath Benefit Advisors Employee Benefits Columbus Ohio

Information about Form 1094C, Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns, including recent updates, related forms, and instructions on how to file Form 1094C is the transmittal form that must be filed with the Form 1095C1921 form 1094c Fill out blanks electronically utilizing PDF or Word format Make them reusable by making templates, include and fill out fillable fields Approve documents by using a legal electronic signature and share them by way of email, fax or print them out download blanks on your PC or mobile device Enhance your productivity with effective solution?Part III ALE Member Information Monthly Line 23 to Line 25 ALE Member Information Reminder Part III (Lines 2335) should only be completed on the Authoritative Transmittal for the employer In Column (a), if you offered Minimum Essential Covertage (MEC) to at least 95% of your fulltime employees and their dependents, enter "X" in

Irs Extends Deadline For Employer Aca Disclosures Buck Buck

W 2 Laser Federal Irs Copy A

F1094c 19 Form 1094C This document is locked as it has been sent for signing You have successfully completed this document Other parties need to complete fields in the document You will recieve an email notification when the document has been completed by all parties This document has been signed by all parties Completed 28 June The IRS has released draft forms and instructions for the 19 BSeries and CSeries reporting forms (Forms 1094B, 1095B, 1094C and 1095C) used by employers and coverage providers to report certain information to fulltime employees and the Internal Revenue Service (IRS) As background, the Affordable Care Act (ACA) added Sections 6055 and 6056 to theForm 1094C and Form 1095C are IRS forms that employers must file if they are required to offer their employees health insurance under the Affordable Care Act (ACA) The primary difference between these two forms is that Form 1095C includes health insurance information and is provided to the IRS and employees

2

Aca Compliance Mzq Consulting

1094c 1921 Complete blanks electronically using PDF or Word format Make them reusable by making templates, include and complete fillable fields Approve documents using a lawful electronic signature and share them via email, fax or print them out Save forms on your laptop or mobile device Improve your productivity with powerful solution?1094c deadline 1921 Complete forms electronically using PDF or Word format Make them reusable by generating templates, add and fill out fillable fields Approve forms by using a legal digital signature and share them through email, fax or print them out Save forms on your PC or mobile device Boost your efficiency with effective solution?Form 1094C Department of the Treasury Internal Revenue Service Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns Go to wwwirsgov/Form1094C for instructions and the latest information OMB No Part I Applicable Large Employer Member (ALE Member) 1 Name of ALE Member (Employer) 2

Control Tables And Sample Forms

Aca Forms

Form 1094C and all corresponding Forms 1095C must be filed electronically with the IRS by ;The IRS released nal 19 Form 1094C, Form 1095C and applicable instructions Applicable large employers ( ALEs ) must furnish the Form 1095C to fulltime employees and le Forms 1094C and all 1095Cs with the IRS What s New While the Forms remain substantially the same to last year s versions, the instructions highlight recent changes as

Blog Form 1095 C

The Irs Aca Audit Has Begun What To Do To Avoid Penalties The Aca Times

Get To Know Aca Forms 1094 C And 1095 C The Aca Times

2

Irs Issues Draft Form 1095 C For Aca Reporting In 21

Your 1095 C Obligations Explained

2

Aca Deadlines Penalties Extension For 21 Checkmark Blog

1

2

2

Www Irs Gov Pub Irs Utl Instructions for ty18 predefined aats scenarios Pdf

New Form 1095 C Draft Issued By Irs For Filing In 22 Bernieportal

Www Hayscompanies Com Wp Content Uploads 18 10 Here Come The 1095s Pdf

Yes Employers Still Need To File Forms 1094 And 1095 Word On Benefits

Filing Form 1094 C Youtube

Otr Cfo Dc Gov Sites Default Files Dc Sites Otr Publication Attachments Dc health care info returns Pdf

Aca Compliance Bulletin Draft Section 6056 Reporting Forms Released Vcg Consultants

2

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

Irs Forms Publications Lattaharris Llp

Some Draft Forms For Aca Reporting Released Resecō

W 2 Laser Federal Irs Copy A

Www Gadoe Org Technology Services Pcgenesis Documents Aca Test File Submission Pdf

What To Expect From The Aca In 19 Shomer

Index Of Software Images

19 Aca Reporting Timeline Pomeroy Group

2

3

Form 1094 C And Form 1095 C B Benchmark Planning Group

2

Tmlhealthbenefits Org Forms Tml Displaydoc Aspx Doc Id 694 Form Webinar

Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Yearli W 2 1099 1095 Online Filing Program

Tmlhealthbenefits Org Forms Tml Displaydoc Aspx Doc Id 694 Form Webinar

2

Bondbenefitsconsulting Com Wp Content Uploads 19 02 Bond Compliance Calendar Pdf

Www Irs Gov Pub Irs Prior Ib 19 Pdf

Www1 Nyc Gov Assets Olr Downloads Pdf Health 1095 C Form Pdf

Office Depot

What You Need To Know About Aca Annual Reporting Aps Payroll

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

Blog Form 1095 C

Tax Forms Office Depot Officemax

2

Http Proware Cpa Com Pdf Filing Requirements Pdf

2

2

Form 1095 A 1095 B 1095 C And Instructions

2

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

2

2

2

Ez1095 Aca Form Software How To Import 1095 C Data From Spreadsheet

2

Irs Releases Draft 19 Aca Reporting Forms And Instructions Alera Group

2

2

2

Form Irs 1094 C Fill Online Printable Fillable Blank Pdffiller

2

Http Cbplans Com Wp Content Uploads 19 12 Aca 19 Final Forms 1094 C And 1095 C Issued Pdf

2

Legal Alert Irs Releases Draft 19 Aca Reporting Forms And Instructions Spring Consulting Group

Form 1095 C H R Block

Www Cml Org Docs Default Source Uploadedfiles Issues Employment Health Care And Wellness Aca Pdf Sfvrsn 8fff1fe8 4

2

Employer Reporting Forms 1094 C And 1095 C Hays Companies

19 Irs Form 1095 C Shea Insurance Llc

Thought Obamacare Was Gone Not Quite Accounting Today

Www Scu Edu Media Offices Human Resources Documents Benefits 1094 C 1095 C Forms Guidance Pdf

17 Form Irs 1094 C Fill Online Printable Fillable Blank Pdffiller

2

Www Opm Gov Healthcare Insurance Fastfacts Health Coverage Forms Fast Facts Annuitants Pdf

0 件のコメント:

コメントを投稿